30 December 2006

29 December 2006

Investment Properties That Aren't: Durbanville

Oh-oh looks like someone might have realised that their Durbanville "investment" property wasn't exactly making them any money. It's on the market for R640 000 (but that's negotiable so go ahead and lowball) and is rented out for R2850. The ROI before rates and maintenance is

Oh-oh looks like someone might have realised that their Durbanville "investment" property wasn't exactly making them any money. It's on the market for R640 000 (but that's negotiable so go ahead and lowball) and is rented out for R2850. The ROI before rates and maintenance is| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R160000 | R-3119 | -23% |

| R320000 | R-1129 | -4% |

| R480000 | R860 | 2% |

| R640000 | R2850 | 5% |

5%? Why that's almost as good as a fixed deposit! But considering that most of the people in these newly built developments are only putting down a deposit of 10%-20% (or less if they convice the banks to give them a 100% loan) I'm sure this seller got tired of losing R3 000 a month.

Investment Properties That Aren't: Tamboersklookf

Here's a 2 bedroomed apartment in Tamboerskloof going for a cool R1 100 000. And look they've already got a tenant lined up paying R3 800 a month in rent. Here's your return on income before paying rates and maintenace:

Here's a 2 bedroomed apartment in Tamboerskloof going for a cool R1 100 000. And look they've already got a tenant lined up paying R3 800 a month in rent. Here's your return on income before paying rates and maintenace:| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-8635 | -104% |

| R300000 | R-6148 | -25% |

| R500000 | R-3661 | -9% |

| R700000 | R-1174 | -2% |

| R900000 | R1313 | 2% |

| R1100000 | R3800 | 4% |

4% with R1 100 000 invested? I'll take two! But let's give the buyer a bit of a break. Let's assume he manages to get R200 000 knocked off the price and gets the place for R900 000.

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-6148 | -74% |

| R300000 | R-3661 | -15% |

| R500000 | R-1174 | -3% |

| R700000 | R1313 | 2% |

| R900000 | R3800 | 5% |

A massive 1% increase on ROI. You'll be rich.

26 December 2006

Atlantic Seaboard: Prices Drop

Over at Cape Property Services, Tom Hood's latest November 2006 housing report has a number of suprises:

Prices of sectional title property were virtually unchanged on average last month and about 4% up on a year ago. However, on the Atlantic Seaboard, prices of flats dipped 11% on average in a month to R1 990 000 and were about 3% lower than a year ago.

25 December 2006

Investment Properties That Aren't: Gardens

Here's a house in Gardens in Cape Town. You can buy it for R2 500 000 (R29 289 a month with our soon to be 13% interest rate), or you can rent it for R12 5000, nearly R17 5000 cheaper than buying a month. If you were to buy it as an 'investment' property here's your return on income.

Here's a house in Gardens in Cape Town. You can buy it for R2 500 000 (R29 289 a month with our soon to be 13% interest rate), or you can rent it for R12 5000, nearly R17 5000 cheaper than buying a month. If you were to buy it as an 'investment' property here's your return on income.| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-15267 | -183% |

| R400000 | R-11859 | -36% |

| R700000 | R-8451 | -14% |

| R1000000 | R-5042 | -6% |

| R1300000 | R-1634 | -2% |

| R1600000 | R1775 | 1% |

| R1900000 | R5183 | 3% |

| R2200000 | R8592 | 5% |

| R2500000 | R12000 | 6% |

You'd have to put down a massive R1 400 000 to break even and the entire cost of the property to make 6% a year ROI. Not exactly scintillating returns is it?

23 December 2006

21 December 2006

Housing under R500 000 offer the best returns

Houses under R500 000 will offer the best returns in 2007

What's R500 000 going to buy you in Cape Town at the moment? A one bedroomed flat in Table View? If you work in town I hope you don't mind 1+ hour commutes.

The best yields in the property market will be found in the lower-priced segment ie, houses under R500 000, next year.

This is according to Rode & Associates CEO, Erwin Rode in the latest Rode Report.

He pointed out that during the third quarter of 2006, lower-priced houses continued to grow faster than those in the middle- and upper-priced sectors.

What's R500 000 going to buy you in Cape Town at the moment? A one bedroomed flat in Table View? If you work in town I hope you don't mind 1+ hour commutes.

17 December 2006

Mboweni Vs. The Banks

Who will it be - Mboweni or the banks?

The current residential property market resembles a crazy court case, with the complainant, SA Reserve Bank governor Tito Mboweni, pleading for a cooling down in the escalation of credit - which includes bonds on homes - to help him contain inflation.

The estate agency industry and those who advance money to borrowers are opposing the motion, which could, if it succeeds, cut their profits.

Average South Africans who can currently afford to borrow money, and who will be affected by the outcome, should be in the gallery, but they're elsewhere, spending money as if it's going out of fashion, seemingly oblivious of the hikes in inflation.

Mboweni is perhaps worried that many of the bond increases granted weren't spent on improving the homes they were borrowed against, but on furniture, holidays and cars, which aren't income producers.

16 December 2006

Guest Post: Could a housing slump help you get that dream house ?

[Note: This is a guest post by reader CJ]

Here's an interesting thought - what is best for your average home owner that aspires to a bigger and better house ? A reduction in house prices or an increase in house prices ?

Lets say life is going well and I can afford to get a 2 bedroomed house in Cape Town's city bowl. It costs me R2 m. I would love to get that incredible 4 bedroomed house but at R4 m it is just too expensive. I can't stretch to an extra R2m.

A year passes. I continue to yearn for that bigger and better house. Suddenly, in a puff of smoke, my fairy godmother appears - she can do one of 2 things for me, she says - she can create a boom and make house prices double or she can create a crash and make them lose half their value. Which choice would get me closer to my dream house ?

Naturally, one would assume that a doubling of prices would be best. Heck, you would be R2m richer, that has to be a good thing doesn't it? Well, yes, if your dream was to sell the house and go cruising around the world … but that is not my dream - what I want is that gorgeous 4 bedroomed house. In that case, strange as it may seem, a house price drop makes it more obtainable.

Take a look at the maths -

So if house prices double I need to find an extra R6m on top of the R2m of easy money I made to get the dream house - if finding 2m extra was tough, getting 6m will be impossible - sadly the dream house must remain just that, a dream.

However look at what happened after the crash. I may have lost R1m when I sell my house but for another R2m I can get the dream house - I might just be able to stretch to that - so for a total outlay of R3m the dream comes true.

Everyone thinks that as house prices rocket they will get closer to their dream house. In reality, the opposite occurs. As prices rise the cost of upgrading to something better becomes increasingly prohibitive. In other words, for the hard working Joe Average who is aspiring to get something bigger, a house price crash could well be an excellent thing.

The people who will really suffer are the speculators who have geared their borrowings to the max in the hope of flipping their houses in a year or two for a hefty profit. When interest rates go up and house prices go down, they are in serious trouble and there will be blood on the streets. But then again, that is why it is called speculation.

At the end of the day, if a decent amount of your bond has been paid off and you are ready to upgrade your lifestyle, a crash shouldn't be something to fear, it might just be the answer to your dreams.

Here's an interesting thought - what is best for your average home owner that aspires to a bigger and better house ? A reduction in house prices or an increase in house prices ?

Lets say life is going well and I can afford to get a 2 bedroomed house in Cape Town's city bowl. It costs me R2 m. I would love to get that incredible 4 bedroomed house but at R4 m it is just too expensive. I can't stretch to an extra R2m.

A year passes. I continue to yearn for that bigger and better house. Suddenly, in a puff of smoke, my fairy godmother appears - she can do one of 2 things for me, she says - she can create a boom and make house prices double or she can create a crash and make them lose half their value. Which choice would get me closer to my dream house ?

Naturally, one would assume that a doubling of prices would be best. Heck, you would be R2m richer, that has to be a good thing doesn't it? Well, yes, if your dream was to sell the house and go cruising around the world … but that is not my dream - what I want is that gorgeous 4 bedroomed house. In that case, strange as it may seem, a house price drop makes it more obtainable.

Take a look at the maths -

| Price of present house | Price of dream house | Total Amount I need to borrow to get dream house | |

|---|---|---|---|

| Now | 2 | 4 | 4 |

| Double | 4 (gained 2m) | 8 | 6 |

| Half | 1 (lost 1m) | 2 | 3 |

So if house prices double I need to find an extra R6m on top of the R2m of easy money I made to get the dream house - if finding 2m extra was tough, getting 6m will be impossible - sadly the dream house must remain just that, a dream.

However look at what happened after the crash. I may have lost R1m when I sell my house but for another R2m I can get the dream house - I might just be able to stretch to that - so for a total outlay of R3m the dream comes true.

Everyone thinks that as house prices rocket they will get closer to their dream house. In reality, the opposite occurs. As prices rise the cost of upgrading to something better becomes increasingly prohibitive. In other words, for the hard working Joe Average who is aspiring to get something bigger, a house price crash could well be an excellent thing.

The people who will really suffer are the speculators who have geared their borrowings to the max in the hope of flipping their houses in a year or two for a hefty profit. When interest rates go up and house prices go down, they are in serious trouble and there will be blood on the streets. But then again, that is why it is called speculation.

At the end of the day, if a decent amount of your bond has been paid off and you are ready to upgrade your lifestyle, a crash shouldn't be something to fear, it might just be the answer to your dreams.

12 December 2006

Property Fraud Alert

Check out this scam:

Property scheme raises warning flags

Notice that bit about a clean credit record because it's going to come in handy when you commit credit fraud.

Yeah that's totally not going to come back and bite you. And the whole scheme relies on property prices increaseing

And if you can't re-finance? Oops looks like you've got four mortages to pay.

Property scheme raises warning flags

A scheme doing the rounds promises to build up a passive income of R168 000 within one year. All that’s required is a monthly salary of R7 000 and a clean credit record.

Notice that bit about a clean credit record because it's going to come in handy when you commit credit fraud.

The first is a trick Optimum uses to maximise clients’ borrowing power. Van Wyk identifies four low-value properties he thinks are suitable for the purposes of the scheme. He then uses a mortgage originator to obtain quotes from each of the big four banks for each of the four properties.

He then accepts the quotes for the properties, but ensures that each is from a different bank. Each bank approves the loan, apparently unaware that three other banks are concurrently approving loans of equal value. This allows Van Wyk’s clients to borrow four times more than banks would normally allow them to. Van Wyk says he understands that there are moves afoot by the banks to close this apparent loophole – in the meantime, however, he is making hay while the sun shines.

Yeah that's totally not going to come back and bite you. And the whole scheme relies on property prices increaseing

Van Wyk says that after a year, his clients apply to the banks for bond re-financing. Of course, this is subject to the properties increasing in value over the period, and therein one finds the greatest risk to Optimum’s scheme.

And if you can't re-finance? Oops looks like you've got four mortages to pay.

09 December 2006

08 December 2006

Dockside: Investment Properties That Aren't

What do you do if you can't sell your 'investment property' for R1.45 million? Why you rent it out for R5000/month. Now let's assume that our seller wants to make 25% profit since he bought it during pre-construction. That means he probably bought it for around R1.1 million. So what's his ROI?

What do you do if you can't sell your 'investment property' for R1.45 million? Why you rent it out for R5000/month. Now let's assume that our seller wants to make 25% profit since he bought it during pre-construction. That means he probably bought it for around R1.1 million. So what's his ROI?| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-5873 | -70% |

| R300000 | R-3671 | -15% |

| R500000 | R-1469 | -4% |

| R700000 | R733 | 1% |

| R900000 | R2935 | 4% |

A whopping 4% return for paying nearly the entire price in cash. With inflation about to hit 6% you're only losing 2% a year in real terms.

And unless you've got more than R350 000 as a down payment you can kiss your 10% deposit goodbye by the end of next year.

Incentives Make An Appearance

Reader RS writes

That's quite an incentive.

I saw an ad in the Southern Mail (dated 28 Nov) last week where a property was being sold for 1.4 mil in Durbanville and the agent is offering a second property (a flat) for FREE.

That's quite an incentive.

07 December 2006

Rate Hikes Up 0.5%

The pain of a fourth rate hike

What was a bit worrying to me was the 73% of household income that goes towards paying debt. 73%!!!

Each time interest rates are raised half a percentage point, people say it’s small - but the reality is that the cost of borrowing at prime has gone up by 19% since June.

The prime rate has risen from 10,5% to 12,5% pa. Monthly payments on a bond financed at prime, have risen nearly 14% in six months. On a million rand bond, that comes to R1 377 a month.

In June, when prime was at 10,5% pa, the mortgage payments on an R1m bond were R9 984 a month. Following rate hikes of 50 basis points each in June, August, October and December, servicing and repaying such a bond now costs a borrower R11 361 a month.

Similarly for a R600 000 bond, payments increased R827 in six months to R6 817.

What was a bit worrying to me was the 73% of household income that goes towards paying debt. 73%!!!

05 December 2006

Could SARB tighten the rates screws?

Could SARB tighten the rates screws?

I expect a 50bp rate hike, but after every single rate hike we always get analysts predicting "disaster!" if the rates go up again. And yet consumer spending is still higher than expected.

Since interest rate policy this year caught analysts off guard more than once, one cannot help wondering what surprises are in store for the market, which confidently expects a 50 basis point rate hike on Thursday. Analysts nevertheless point out that anything other than a rate rise of this magnitude could spell disaster.

I expect a 50bp rate hike, but after every single rate hike we always get analysts predicting "disaster!" if the rates go up again. And yet consumer spending is still higher than expected.

Estate Agents: "We're begging you please keep buying!"

Want that bigger home? Now is the time

Sure thing. I love catching falling knives! Interest rate set to go up on Thursday, and with credit levels going through the roof, are set to continue to go up in the 2007. Why buy now when you can wait a year or two for the market to soften up even further.

People are extracting money out of their bonds as quickly as possible and if house prices do not rise a lot of people will be left underwater on their bonds. Best quote though is this:

Yeah tell that to the residents of Green Point who are fighting tooth and nail (probably unsuccessfully) to prevent the building of the World Cup stadium their. They must hate property price appreciation! Is there any data out there showing the World Cup (or the Olympics for that matter) boosting property prices or is this just a complete thumbsuck? I can understand hotel and holiday accomadation rates going up but no one is going to buy a flat and expect to pay it off over the one month of the competition.

Now is the time to buy if you are looking to upgrade to a bigger property. This is the message from economists and estate agents, as property prices level off in what has become more of a buyer's market in recent months.

Sure thing. I love catching falling knives! Interest rate set to go up on Thursday, and with credit levels going through the roof, are set to continue to go up in the 2007. Why buy now when you can wait a year or two for the market to soften up even further.

Data released by the South African Reserve Bank showed that mortgage advances had increased by 30.9 percent in October compared to the same month last year, Absa's economist, Jacques du Toit, said in the bank's latest property report.

People are extracting money out of their bonds as quickly as possible and if house prices do not rise a lot of people will be left underwater on their bonds. Best quote though is this:

They say it may not be long before the market faces further price hikes in the run-up to the 2010 World Cup.

Yeah tell that to the residents of Green Point who are fighting tooth and nail (probably unsuccessfully) to prevent the building of the World Cup stadium their. They must hate property price appreciation! Is there any data out there showing the World Cup (or the Olympics for that matter) boosting property prices or is this just a complete thumbsuck? I can understand hotel and holiday accomadation rates going up but no one is going to buy a flat and expect to pay it off over the one month of the competition.

02 December 2006

Guest Post: Blowing bubbles in the Cape Town Property Market

[Note: The following is opinion piece is by regular reader CJ]

It is important to remember that the people who should be telling us the truth, might be holding back on us. Let us take a closer look.

First there are all the property ‘experts’ that are dragged out at regular intervals by the media to make proclamations. Have you noticed that they all work formajor banks. In a property crash the banks will be the first to feel the pain as borrowers default on repaying bonds on homes with negative equity. Do you think they are going to be totally honest with us if the answer hurts their employer? “Hey guys, I’ve got to admit, the housing market is looking rather dodgy at present, might be a good time to offload that house while you still can … oops … can’t say that, might cause our customers to panic … well, what I actually mean is, the market is presently going through a period of consolidation but over the long term we anticipate continued growth …”.

So maybe the newspapers will tell us the truth ? So that would be the same papers that sell advertisements to estate agents in property supplements that are as thick as telephone directories. You think these guys are going to upset their cash cow by telling us some unpleasant truths ?

Then of course there are the estate agents – that noble band of business folk that weren’t happy just selling us places to live, they now sell us ‘investments’ … and charge us an exorbitant 7.5% for placing a few ads in the papers. I know of one ‘investment’ that was sold 4 times over 18 months – that’s 30% commission, a nice little earner. With rich pickings like this it is not surprising that their numbers have multiplied 4 fold in recent years. You think they are going to tell you that the party is over ? Come the crash more than half of them are going to be unemployed.

Will our political leaders tell us ? Well the world’s governments are certainly worried as they see the warning signs and they are definitely concerned, but the politicians are also being careful not to panic their populations into a crash, as inevitably recession will follow. They are all desperately trying for a soft landing. This is all very well but if you look at the graphs of real house prices (house prices adjusted for inflation), the present peaks are so incredibly high to anything previously seen that talk of a soft landing is as likely as a jumbo jet that has run out of fuel gliding gently down to the runway.

Finally, as in any bubble, a lot of people have got rich by doing nothing but owning a house. I know one city bowl house that is now valued at 900% more than it was sold for 10 years ago with only minor improvements. Telling your average home owner that anything that goes up that quickly can just as easily come down, is not something they want to know. House prices always go up, they say, everyone knows that. Do they ? The Japanese might disagree – their property market crashed in the early 90s and 16 years later values are still only half what they were at the peak.

Housing has become a commodity like gold, oil, tech shares, or tulips. As long as there is some sucker willing to pay more for a commodity than you paid, the price will keep going up. When the suckers dry up, then I am afraid the sucker is you.

It is important to remember that the people who should be telling us the truth, might be holding back on us. Let us take a closer look.

First there are all the property ‘experts’ that are dragged out at regular intervals by the media to make proclamations. Have you noticed that they all work formajor banks. In a property crash the banks will be the first to feel the pain as borrowers default on repaying bonds on homes with negative equity. Do you think they are going to be totally honest with us if the answer hurts their employer? “Hey guys, I’ve got to admit, the housing market is looking rather dodgy at present, might be a good time to offload that house while you still can … oops … can’t say that, might cause our customers to panic … well, what I actually mean is, the market is presently going through a period of consolidation but over the long term we anticipate continued growth …”.

So maybe the newspapers will tell us the truth ? So that would be the same papers that sell advertisements to estate agents in property supplements that are as thick as telephone directories. You think these guys are going to upset their cash cow by telling us some unpleasant truths ?

Then of course there are the estate agents – that noble band of business folk that weren’t happy just selling us places to live, they now sell us ‘investments’ … and charge us an exorbitant 7.5% for placing a few ads in the papers. I know of one ‘investment’ that was sold 4 times over 18 months – that’s 30% commission, a nice little earner. With rich pickings like this it is not surprising that their numbers have multiplied 4 fold in recent years. You think they are going to tell you that the party is over ? Come the crash more than half of them are going to be unemployed.

Will our political leaders tell us ? Well the world’s governments are certainly worried as they see the warning signs and they are definitely concerned, but the politicians are also being careful not to panic their populations into a crash, as inevitably recession will follow. They are all desperately trying for a soft landing. This is all very well but if you look at the graphs of real house prices (house prices adjusted for inflation), the present peaks are so incredibly high to anything previously seen that talk of a soft landing is as likely as a jumbo jet that has run out of fuel gliding gently down to the runway.

Finally, as in any bubble, a lot of people have got rich by doing nothing but owning a house. I know one city bowl house that is now valued at 900% more than it was sold for 10 years ago with only minor improvements. Telling your average home owner that anything that goes up that quickly can just as easily come down, is not something they want to know. House prices always go up, they say, everyone knows that. Do they ? The Japanese might disagree – their property market crashed in the early 90s and 16 years later values are still only half what they were at the peak.

Housing has become a commodity like gold, oil, tech shares, or tulips. As long as there is some sucker willing to pay more for a commodity than you paid, the price will keep going up. When the suckers dry up, then I am afraid the sucker is you.

01 December 2006

Property prices hardly moving

Property prices hardly moving

Growth in property prices may have slightly ticked up in October and November but residential property prices are virtually stagnating, warned Standard Bank.

It said volatility in the monthly housing data masked the strong downward trend but the housing market continues to slow.

30 November 2006

Estate Agents "Ignore the price declines! Keep Buying!"

Folks you don't need me to tell you: Never ever listen to an estate agent when it comes to getting an opinion about property.

SA’s property market’s soft landing nothing to fear - Seeff

To translate: "Keep buying! Please for the love of god keep buying!"

The most hilarious quote though is this:

Yeah the US property market is totally not in freefall at the moment.

SA’s property market’s soft landing nothing to fear - Seeff

SA’s property market is currently having a soft landing, which will put it in a strong position to spring forward from, reckoned top realtors.

“Given that almost a decade ago, we survived an interest rate of 25%, followed by eight years of an average of 15%, the current 12% is hardly cause for alarm, says Samuel Seeff, chairperson of Seeff Property.

To translate: "Keep buying! Please for the love of god keep buying!"

The most hilarious quote though is this:

Golding said residential property market analysts are closely watching the US market but contrary to expectations, there doesn’t seem to be a slide in the property market, despite rising interest rates.

Yeah the US property market is totally not in freefall at the moment.

29 November 2006

Rate Hikes Ain't Stopping

Everyone was hoping there wouldn't be a rate hike before Christmas but with rampant consumer spending it's becoming clear that a hike before the 25th of December is a dead certainty and after that Reserve Bank Governor Mboweni is going to pause right? Right!?! Well maybe not. It seems economists are now expecting rake hikes into 2007 as well. So why doesn't Tito stop pussy footing around with 50bp hikes and just raise it 100bp already?

25 November 2006

21 November 2006

Number Crunching Time

I love my readers because sometimes when I'm feeling lazy they do all the hard number crunching for me. Allow me to quote parts from a voluminous email from reader CJ:

If only the rest of my life was as easy as coming up with this entry.

Thanks CJ!

Last year out of curiousity and frustration that we

were being told that the average SA property was

R750,000 I added the average houseprice of the midweek

Cape Times property supplement - the average price

available to Capetonians looking for a house was R2.2

million. The average house price in the UK at that

time was R2m - DON'T tell me SA property is cheap. The

salaries and rents here are at least 3 times lower yet

the house prices being advertised are more ... In the

first section of the Weekend Argus property supplement

the average price was even higher at R3.2m OUCH

...

have a nice 2 bedroom duplex in the city bowl, nice

view, security complex. The rent is by no means cheap

- more than a secretary's salary. Yet when I go over

the numbers I would still be a fool to buy.

Lets say I want to stay here for 3 years. What is the

difference if I rent for 3 years or if I buy the house

now and then sell in 3 years.

Well, at present interest rates at a full bond, and

assuming I sold for the same price as I bought, I

would need 11.5 years rent to cover the interest

payment, and 7 years rent to cover the buying and

selling costs. So If I rent I lose 3 years rent, but

if I buy I lose the equivalent of 18.5 years rent -

well that is a no brainer. Ahh, they all cry, the

price will go up. Well lets assume that even though

the prices in Capetown have gone up between 300 and

900% in the last 10 years, these crazy increases will

keep on happening - the house will still have to go up

more than 50% over those 3 years before it becomes

cheaper to buy than to rent. More realistically, the

selling price will drop. If the price is 10% lower

then my 3 years "investment" loses me the equivalent

of 22 years rent, at a 20% drop I lose 25 years rent,

and a 30% crash will lose me 28 years rent.

Wow, this is a toughie - so lets see, I can live here

for 3 years and pay 3 years rent or I can buy and risk

having to end up paying as much as 28 years rent for

exactly the same thing in the hope that the price

increases more than 50 % and I can make a capital

profit.

...

Here's another interesting situation involving the

'foreign investors' - lets say you bought a cape town

flat for R2m last year - your brought over R1.34 m to

cover a 50% deposit and enough to pay the purchase

costs and the 1st years interest on a local bond. The

pound exchange rate is 10.5.

You now decide to sell. You pay selling costs, 5%

foreigners tax, the balence outstanding and then send

the rest home to the UK at 14 to the pound exchange

rate. If you manage to sell at the same price you

bought, your "investment" has lost you R1.1m. OUCH

again. Wait another year and if we get a 30% drop in

price then your losses are now in the R1.7m area if

the exchange rate stays the same.

Alternatively, the investors could have rented the

exact same house and put their deposit in a UK bank at

6 % - the interest would cover the rent and there

would be R50000 left over for spending money - now

that sounds like a better idea than losing a million

or two by buying the exact same property.

If only the rest of my life was as easy as coming up with this entry.

Thanks CJ!

18 November 2006

17 November 2006

The Rockwell: Sales Are Stagnant

When we last checked in at the Rockwell two months ago sales seemed to be slowing down, as they had sold 83 units out of a total of 150. Two months later they've increased that sales count by grand total of one 1 (according to their availability page - I counted 84 sold).

When we last checked in at the Rockwell two months ago sales seemed to be slowing down, as they had sold 83 units out of a total of 150. Two months later they've increased that sales count by grand total of one 1 (according to their availability page - I counted 84 sold).

11 November 2006

08 November 2006

Black Middle Class Doesn't Exist - Saki Macozoma

One of the justifications for the large run up in South Africa's housing prices was the emergence of the 'black middle class', something that is brought up as the saviour of almost every possible economic woe. High housing prices unsustainable? They are thanks to the 'black middle class'. Massive deficit due to the retail sector importing foreign goods? It's alright the 'black middle class' will keep on buying imported goods. And so on and so forth.

Except there could be a slight problem. The 'black middle class' might not exist at all:

Except there could be a slight problem. The 'black middle class' might not exist at all:

The so-called black middle class does not really exist, says politician-turned-businessman Saki Macozoma.

"It is a (mere) conceptual construction," Sake Beeld reported him as saying on Wednesday.

Macozoma, formerly an African National Congress MP and currently chairman of financial services group Stanlib, said the black group concerned did not have much of a "class consciousness", it should rather be described as a category.

The group could not sustain its own continued existence as members either rose rapidly into the high income group or fell back into the lower income groups.

On top of this, the group lacked the organised political mobilisation required to defend its economic progress.

Real decline in house prices

Real decline in house prices

House prices in October grew at the slowest rate in more than six years, according to the Absa House Price Index (HPI) and the lows are expected to continue.

Last month, nominal house price growth of 12,7% year-on-year was recorded. This is the lowest growth since January 2000, when it was 11,8%.

In real terms, year-on-year growth of 7,8% was recorded in September compared with a revised growth rate of 8,1% in August, based on the headline consumer price index.

The average nominal house price growth for the first ten months of the year came to 14,7% and the bank forecasts a growth rate of 14% for the year.

Next year, it projects house price growth of around 6%. The bank noted that for the first time in seven years, prices are expected to decline by almost 2% in real terms.

04 November 2006

29 October 2006

Investment Properties That Aren't

Excellent Property Investment - Asking price R870 000, current rental R4000.

Fantastic investment opportunity - Asking price R657 000, expected rental R3000 (rental subsidy offered for first year)

4% and 5% max ROI before maintenance, insurance and rates? Just tell me where to sign!

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-4212 | -51% |

| R200000 | R-3145 | -19% |

| R300000 | R-2079 | -8% |

| R400000 | R-1012 | -3% |

| R500000 | R54 | 0% |

| R600000 | R1121 | 2% |

| R700000 | R2187 | 4% |

| R800000 | R3253 | 5% |

Fantastic investment opportunity - Asking price R657 000, expected rental R3000 (rental subsidy offered for first year)

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-3132 | -38% |

| R200000 | R-2066 | -12% |

| R300000 | R-999 | -4% |

| R400000 | R67 | 0% |

| R500000 | R1134 | 3% |

| R600000 | R2200 | 4% |

4% and 5% max ROI before maintenance, insurance and rates? Just tell me where to sign!

28 October 2006

21 October 2006

17 October 2006

Investment Properties That Aren't

Here's a two bedroomed flat right on Stellenbosch university campus. It's earns a rent of R5000 per month. And seeing that it's asking price is R1 500 000 that means you'll only lose R10 000 a month on it. You'll only break even if you put a whopping R1 100 000 down as deposit. What an investment! I'll take two!

16 October 2006

Distressed Sellers Emerge!

I guess Tito's 50bp rate hike (and the expected 50bp hike in December) is finally putting the strain on some speculators:

Thanks to reader SG for this gem!

A beautiful bachelor flat across from the gardens in Cape Town.

Secure complex with a pool and a lovely spacious garden.

The flat has a large separate kitchen, with wooden floors.

Lots of cupboard space and a balcony with a view of Lions head.

Approx. R65 000 under market value. Urgent sale

Thanks to reader SG for this gem!

14 October 2006

12 October 2006

50bp Repo Rate Hike

Reserve Bank Governor Tito Mboweni hiked the repo rate 50bp (0.5%) today. It's expected to go up another 50bp in December. Tito is still sweating over high debt levels:

Mboweni warned that the inflation outlook remained under threat, with record levels of credit demand and household debt fuelling domestic demand.

11 October 2006

Rent Vs. Rent: Gardens Vs. Clifton

Another hallmark of speculative bubbles is amateur investors trying desperately to cover their massive mortages with outlandish rents. Consider the following two properties without clicking on the links: A two bedroom apartment in Clifton or a 3 bedroom duplex apartment in Gardens. Which one do you think has the higer asking rent? Which one do you think was bought in the last two years?

07 October 2006

03 October 2006

Badly Worded Ads

Here's this week's winner of the badly worded ad of the month award (emphasis mine):

I promise the crimes not bad! The police are everywhere!

Seperate kitchen & bathroom. Balcony with views over Long str, Harbour and Signal Hill. Double BICs & linen cupboard, dark wood lamanated floors, newly painted etc etc.Building newly renovated,security & not as dodgy as everyone seems to think! Cars are safe on the street as lots of movement 24hours with OrangeKloof Security & CPT Police doing the rounds!

I promise the crimes not bad! The police are everywhere!

Another low for house price growth

Another low for house price growth

House prices in September grew at the slowest rate since December 2002, according to Standard Bank’s residential property gauge.

The bank reported that last month, house prices were only 2,9% higher than a year earlier. The five-month moving average growth rate slowed nearly 23% from 8,7% y/y in August to 6,7% y/y in September.

01 October 2006

Woodstock Asking Rents Still Dropping

Waaaaay back in May we talked about a new block of apartments in Woodstock called Harbour Views, particularly we talked about an 'investor' who had picked probably the worst view possible to advertise the place and was trying to rent it for R3500 a month. Well it seems the apartment is still available except rent has dropped R200 a month. I thought rent was supposed to go up in an environment with increasing interest rates?

Waaaaay back in May we talked about a new block of apartments in Woodstock called Harbour Views, particularly we talked about an 'investor' who had picked probably the worst view possible to advertise the place and was trying to rent it for R3500 a month. Well it seems the apartment is still available except rent has dropped R200 a month. I thought rent was supposed to go up in an environment with increasing interest rates?

Investment Properties That Aren't

We return once again to De Waterkant. Here's a one bedroomed loft apartment for sale for R1 400 000. It's described as a "a fantastic investment opportunity". That's got to mean a yield of like 20% a year right? Well here's a one bedroomed loft in De Waterkant for rent for R4500 a month. In fact from the description and the fact that the same agency posted both listings it sounds like it's in the same block. So how fantastic of an investment is it?

We return once again to De Waterkant. Here's a one bedroomed loft apartment for sale for R1 400 000. It's described as a "a fantastic investment opportunity". That's got to mean a yield of like 20% a year right? Well here's a one bedroomed loft in De Waterkant for rent for R4500 a month. In fact from the description and the fact that the same agency posted both listings it sounds like it's in the same block. So how fantastic of an investment is it?| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| R100000 | R-8918 | -107% |

| R300000 | R-6854 | -27% |

| R500000 | R-4790 | -11% |

| R700000 | R-2725 | -5% |

| R900000 | R-661 | -1% |

| R1100000 | R1403 | 2% |

| R1300000 | R3468 | 3% |

3% yield with close to a 100% deposit? Fantastic indeed.

30 September 2006

17 September 2006

The Rockwell: Lots Of Inventory To Go

Earlier in May we reported that The Rockwell, a new development in

Earlier in May we reported that The Rockwell, a new development in They've added more units than they've sold in the past 4 months and are now selling on average 7 units a month. At that rate it will take 10 more months for them to sell out completely. However there are two factors still to take into account. Housing sales are heading for a slump as two more interest rates are expected and secondly those early 'investors' are going to be putting their units on the market the second they're completed adding to the inventory available. You can keep up with their development progress here.

16 September 2006

14 September 2006

Rent Vs. Buy: Gardens

Time for another installment of Rent Vs. Buy! This time the area under concern is the Gardens just above the Cape Town CBD. Click on the picture below to see the two apartments (one for rent, the other for purchase) under consideration:

So one two bedroomed apartment for rent for R3800 a month, the other (also two bedroomed) for sale for R1 050 000. Let's run the numbers:

You're only breaking even with a close to 70% down payment and netting a 3% yield with almost a 100% deposit. And to add to the losses we have not factored in rates (knock off at least R600 a month in income, more if the place has an elevator), insurance and maintenance. Something is out of whack if you ask me.

So one two bedroomed apartment for rent for R3800 a month, the other (also two bedroomed) for sale for R1 050 000. Let's run the numbers:

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -6006 | -72 |

| 300000 | -3941 | -16 |

| 500000 | -1877 | -5 |

| 700000 | 187 | 0 |

| 900000 | 2252 | 3 |

You're only breaking even with a close to 70% down payment and netting a 3% yield with almost a 100% deposit. And to add to the losses we have not factored in rates (knock off at least R600 a month in income, more if the place has an elevator), insurance and maintenance. Something is out of whack if you ask me.

12 September 2006

SA Home Loans To Introduce Interest Only Mortages

Sound the alarm bells!!! SA Home Loans(SAHL) is going to introduce interest only mortages:

This is the very type of mortage that sparked off the bubble in the US and is now responsible for the bubble implosion there, with flippers starting to panic as their IO periods reset and they have to start paying off the principle on mortages they can now not afford.

In real terms this is not even a mortage. You're basically renting from the bank during the IO period and when the reset period kicks in and you have to start paying off the principle of the mortage your monthly payments can increase dramatically.

SAHL, also announced the launch of a new type of home loan whereby clients only have to pay the interest on the outstanding balance.

According to Penwarden, the new product allows for huge flexibility as clients can choose to pay either, only the interest, the full monthly instalment or any amount over and above that.

Penwarden believes that this product caters to the needs of modern consumers who no longer pay off a house over the full term of the bond.

This is the very type of mortage that sparked off the bubble in the US and is now responsible for the bubble implosion there, with flippers starting to panic as their IO periods reset and they have to start paying off the principle on mortages they can now not afford.

In real terms this is not even a mortage. You're basically renting from the bank during the IO period and when the reset period kicks in and you have to start paying off the principle of the mortage your monthly payments can increase dramatically.

11 September 2006

R5,2 million For Sand

'Hout Bay sand' selling for R5,2m

Apparently another development built close by to the beach is turning into a disaster:

A sandy plot, which looks like a piece of beach, is up for sale in Hout Bay for R5,2-million.

Some residents thought the estate agent's advertisement was a joke, but the residents' association say the sale is real and an example of the absurd levels to which the development frenzy has risen on the South African coast.

Len Swimmer, chairperson of the Residents' Association of Hout Bay, said of the plot yesterday: "It's right on the beach, a sand dune, and the public access goes right through it.

"We've sent an email to everyone who the estate agents sent the advert to, telling them that we will oppose anything built on that plot," he said.

Apparently another development built close by to the beach is turning into a disaster:

At Hout Bay, earth-moving machines have been brought in to try to keep the sand out of the controversial Beach Club development in the dunes. It is illegal to destroy dunes without a permit.

...

But developers were not known for their "forward thinking" nor for considering the long-term consequences of their actions, he said. As a result, Beach Club homeowners had their gardens "transformed into large sand dunes".

10 September 2006

Number Of Estate Agents To Be Cut In Half

One thing about the bubble housing market is that the number of estate agents rise dramatically. What about in a cooling market? Well let's just say the metaphors used by our business media invoke carnage...

Mass culling of surplus estate agents on the way

That's right folks. From 77 000 agents to 36 000, more than a 50% cut in the estate agent population.

Mass culling of surplus estate agents on the way

THE good times are over for estate agents in the residential property market as rising interest rates turn on the heat and buyers stay away.

“We’ve had a fantastic rainy season, but with the rains have come many weeds. And when the dry season arrives only the trees will be left standing,” said Neville McIntyre, chief executive of Jigsaw Holdings, which includes estate agencies Aida and Realty.

McIntyre said the number of agents had increased from about 57000 in May last year to the current 77000.

This, he said, was because of the low requirements for entry to the occupation — no qualifications are required to become an estate agent.

McIntyre said the industry had the capacity to cope with only 32000 to 36000 agents. He foresees “a major fallout” of estate agents as soon as the residential property market tightens further.

That's right folks. From 77 000 agents to 36 000, more than a 50% cut in the estate agent population.

09 September 2006

Trevor Manuel Begs Consumers To Cut Down On Credit

We're using too much credit, warns Manuel

'I think they will get into trouble'Manuel said Reserve Bank governor Tito Mboweni had on at least three occasions spoken about rising debt and how consumers should limit spending on credit, but the message had not hit home.

"He was sending a warning about this," he said, adding that some people could soon start facing serious problems paying their housing bonds.

Manuel also expressed concern that some stores were offering mortgage and auto finance to their customers.

"I think they will get into trouble. It is this kind of thing that feeds the appetite (spending on credit), resulting in people being addicted to credit," he continued.

07 September 2006

Tito Targets House Prices With Rate Hikes

In the US, Federal Reserve Chairman Ben Bernanke has not mentioned housing prices as a cause for raising interest rates out of fear that he might cause their imploding bubble to crater overnight. Our Reserve Bank Governor Tito Mboweni however knows when to call a spade a spade:

We had not properly anticipated or priced in the sociology of interest rate reductions -- economics is about human behaviour -- and the sociology of the lower interest rate environment was that for the bulk of the population the experience of these interest rates was unknown -- they went and bought a second

or third car, five DVD systems, ten handbags, three or four houses -- they went on a spending spree such that loans and advances to the private sector was at 23% in June and then rose to 34,6% in July

06 September 2006

Asking Prices Head South

Although not as widely used as it could be PrivateProperty.co.za allows us to see when properties

have their asking price reduced.

Of the 16 properties listed in the City Bowl 9 are price reduced.

Of the 22 properties listed in the Atlantic Seaboard 9 are price reduced.

have their asking price reduced.

Of the 16 properties listed in the City Bowl 9 are price reduced.

Of the 22 properties listed in the Atlantic Seaboard 9 are price reduced.

04 September 2006

Building Boom Brings Shoddy Workmanship

The property bubble has meant a lot of things. Higher property prices, rampant credit spending and now substandard buildings:

There's only so much skilled labour around, and with all the new construction and rushed deadlines it's stretched pretty thin. And this rising number of accidents on work sites is an indication of crappy labour and substandard quality control. So if you're sitting in your newly built development townhouse, you might want to start checking the walls for cracks every now and then.

The current property boom and pressure to meet building deadlines are cited as the main reasons why construction companies flout building regulations, resulting in an increasing number of accidents.

The employment of unskilled workers and failure to provide training has also resulted in many fatal incidents.

There's only so much skilled labour around, and with all the new construction and rushed deadlines it's stretched pretty thin. And this rising number of accidents on work sites is an indication of crappy labour and substandard quality control. So if you're sitting in your newly built development townhouse, you might want to start checking the walls for cracks every now and then.

03 September 2006

Housing Prices: No One Has A Clue!

As the outlook for housing prices continues to get bleaker the interesting thing to note is that the snoozing economists at our major banks don't seem to know what the hell is going on. Observe this quote:

Two economists at two of our biggest banks have a nealry 100% discrepancy in price growth outlook? That's just a tad worrying to me. I don't care how different their methodology or how client base is, a disparity that big means we're moving into into a time when economists are literally pulling numbers out of thin air because they have no idea what the market will do.

Jacques du Toit, Absa property economist, expects house price inflation to average 12% this year....

Standard Bank released its equivalent index earlier this week, which reflected July house price inflation of 6%...

Two economists at two of our biggest banks have a nealry 100% discrepancy in price growth outlook? That's just a tad worrying to me. I don't care how different their methodology or how client base is, a disparity that big means we're moving into into a time when economists are literally pulling numbers out of thin air because they have no idea what the market will do.

02 September 2006

31 August 2006

Expect "Aggressive" Interest Rate Hikes

Ooops. Looks like local economists were caught napping again. Seems SA's trade deficit is worse than people were expecting... again!

Okay we were expecting a 1%-2% rate hike by the end of the year before this news. Can we expect perhaps a 3% hike by the end of the year now?

This data shows that the structural imbalances remain very much intact but suggest that the South African Reserve Bank needs to hike more aggressively than we originally anticipated.

Okay we were expecting a 1%-2% rate hike by the end of the year before this news. Can we expect perhaps a 3% hike by the end of the year now?

29 August 2006

Rent Vs. Buy Extravaganza!!!

Ok I haven't done this in a while so here's a whole smattering of Rent Vs. Buys!

First up. Woodbridge Island Milnerton. a 3 bedroomed townhouse rents for R4800 and sells for R1 570 000.

3% return! You'll be rich!

Next up 3 'investment opportunities' on the Atlantic seaboard. Here's an apartment that rents for R4500 (max) and is on the market for R850 000. What's the return like?

6%? Might as well put it in a fixed deposit and avoid the hassle of running after tenants.

Another apartment this time renting for R4000 a month till the end of January and on the market for R1 100 000. What kind of return can you expect?

Where do I sign up?!? And finally an apartment described as perfect for the world cup that is currently rents for R3200 but you can buy it for R625 000.

Again at 6% probably our best bet, but with interest rates on the way up putting you R625 000 in a high yield fixed deposit ain't the stupidest move either.

First up. Woodbridge Island Milnerton. a 3 bedroomed townhouse rents for R4800 and sells for R1 570 000.

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -10373 | -124 |

| 300000 | -8309 | -33 |

| 500000 | -6244 | -15 |

| 700000 | -4180 | -7 |

| 900000 | -2116 | -3 |

| 1100000 | -51 | 0 |

| 1300000 | 2013 | 2 |

| 1500000 | 4077 | 3 |

3% return! You'll be rich!

Next up 3 'investment opportunities' on the Atlantic seaboard. Here's an apartment that rents for R4500 (max) and is on the market for R850 000. What's the return like?

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -3241 | -39 |

| 200000 | -2209 | -13 |

| 300000 | -1177 | -5 |

| 400000 | -145 | 0 |

| 500000 | 887 | 2 |

| 600000 | 1920 | 4 |

| 700000 | 2952 | 5 |

| 800000 | 3984 | 6 |

6%? Might as well put it in a fixed deposit and avoid the hassle of running after tenants.

Another apartment this time renting for R4000 a month till the end of January and on the market for R1 100 000. What kind of return can you expect?

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -6322 | -76 |

| 300000 | -4258 | -17 |

| 500000 | -2193 | -5 |

| 700000 | -129 | 0 |

| 900000 | 1936 | 3 |

| 1100000 | 4000 | 4 |

Where do I sign up?!? And finally an apartment described as perfect for the world cup that is currently rents for R3200 but you can buy it for R625 000.

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -2219 | -27 |

| 200000 | -1187 | -7 |

| 300000 | -155 | -1 |

| 400000 | 878 | 3 |

| 500000 | 1910 | 5 |

| 600000 | 2942 | 6 |

Again at 6% probably our best bet, but with interest rates on the way up putting you R625 000 in a high yield fixed deposit ain't the stupidest move either.

26 August 2006

21 August 2006

Rent Disparity

Here are a few ads posted in the Independent Group Classifieds:

Now notice that second Camps Bay listing. 3 Bedrooms for R4900. Now look at the first. I'm not sure if a pool and a nice view is worth an extra R13 000 a month.

Also look at the bottom two ads made up of 2 and 3 bed units in Century City for between 4000 and R6000 a month.

So a 3 bedroom apartment in Century city for R6000 where the closest attraction is a giant gaudy shopping center and huge junk food court and where it takes 40 minutes to get through the traffic to town. Or R4900 for a 3 bedroomed place in Camps where one of the best beaches in the world is just down the road, lined with loads of restaurants and town a 10 minute drive away.

Decisions... decisions..

CAMPS BAY Beautiful seaview, lux fully furn, 3 bedrms all en suite,

study, large kitchen, pool, R18 000. Avail imm. Phone 072 392 6794 (CAPE

ARGUS - 21/08/2006)

CAMPS BAY:3 bedrooms, bic, carpeted, small quiet & secure building. Suit

mature couple, R4 560. Garage R400. Permanent Trust 4259790 / 4254747,

a/h 072 369 8054 (CAPE ARGUS - 21/08/2006)

Century City The Island Club 2 bed units at R4500 p/m. 3 Beds at R6000

p/m, available at this award winning development. Gym, indoor pool and

outdoor pool available for exclsaive use of residents. Contact Claire on

5513354 or 0825606481. (CAPE ARGUS - 21/08/2006)

Century City Villa Italia and Bougain Villas 2 bed units at R4000 p/m. 3

Beds at R5500- R6000 p/m. Gym and heated pool facilities available at

Villa Italia. Clubhouse and braai facilities available at Bougain

Villas. Close proximity to Canal Walk and all other amenities offered at

Century City. Contact Michelle on 5513354 or 0833436805. (CAPE ARGUS -

21/08/2006)

Now notice that second Camps Bay listing. 3 Bedrooms for R4900. Now look at the first. I'm not sure if a pool and a nice view is worth an extra R13 000 a month.

Also look at the bottom two ads made up of 2 and 3 bed units in Century City for between 4000 and R6000 a month.

So a 3 bedroom apartment in Century city for R6000 where the closest attraction is a giant gaudy shopping center and huge junk food court and where it takes 40 minutes to get through the traffic to town. Or R4900 for a 3 bedroomed place in Camps where one of the best beaches in the world is just down the road, lined with loads of restaurants and town a 10 minute drive away.

Decisions... decisions..

19 August 2006

14 August 2006

12 August 2006

11 August 2006

10 August 2006

Bubble In Johannesburg

It's not just in Cape Town. Here' a report about Johannesburg's attempt to revitalise the inner city by building high price designer flats

Designer flats empty

Designer flats empty

Despite the perception that downtown, inner city living is fast becoming a preferred choice among Jo'burg's trendy set, owners of upmarket office-to-flat conversions are apparently battling to find tenants.

Property commentators say it's one thing for developers to sell high-end CBD products off-plan to buy-to-let investors - typically priced at between R10 000 and R15 000m² - but to let these units once completed is an entirely different matter.

05 August 2006

03 August 2006

Reserve Bank Hikes Rates Again

Mboweni rings in another rate hike

As momentum from a consumer spending spree continues and inflationary pressures remain, South African reserve Bank governor Tito Mboweni announced a 0.5 percentage point hike in the central bank's repurchase rate to 8 percent on Thursday.

The rise in rates follows a surprise 0.5 percentage point hike - from 7 percent to 7.5 percent - on June 8, the first rate hike since September 2002, when the rate went from from 12.5 percent to 13.5 percent.

30 July 2006

Investment Properties That Aren't

There was an ad for a 2 bedrooomed aparment in St Martini Garden's advertised for sale. Asking price R1.595 million with a tenant (until September) paying R4950. Now if you bought the flat for that price and put in a new tenant at that rental what kind of investment returns are you looking at?

3% ROI with nearly a 100% deposit? Ouch.

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -10481 | -126 |

| 300000 | -8417 | -34 |

| 500000 | -6352 | -15 |

| 700000 | -4288 | -7 |

| 900000 | -2224 | -3 |

| 1100000 | -159 | 0 |

| 1300000 | 1905 | 2 |

| 1500000 | 3969 | 3 |

3% ROI with nearly a 100% deposit? Ouch.

29 July 2006

27 July 2006

SA Banks Told To Tightnen Lending Standards

Ombudsman cautions SA banks against reckless lending

THE Ombudsman for Banking Services has warned banks against reckless lending which could land consumers in financial trouble.

The ombudsman says banks may be doing this to grow their customer bases ahead of strict new lending criteria that will be introduced under the National Credit Act (NCA) next June.

26 July 2006

Investment Properties That Aren't

Here's an ad in today's paper for a flat for sale in Moullie Point:

Let's run those numbers:

So to break even you'll need to put down a 50% deposit. And that rental is waay too high for a one bedroom. Two bedroom flats can easily be found for R6500 with one bedroom flats going for less than R4000/month.

MOUILL POINT Investors 1 bed, R1 190 000 incl. tenant - R7 000 p/m.

Let's run those numbers:

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -4251 | -51 |

| 200000 | -3219 | -19 |

| 300000 | -2186 | -9 |

| 400000 | -1154 | -3 |

| 500000 | -122 | 0 |

| 600000 | 910 | 2 |

| 700000 | 1942 | 3 |

| 800000 | 2974 | 4 |

| 900000 | 4007 | 5 |

| 1000000 | 5039 | 6 |

| 1100000 | 6071 | 7 |

So to break even you'll need to put down a 50% deposit. And that rental is waay too high for a one bedroom. Two bedroom flats can easily be found for R6500 with one bedroom flats going for less than R4000/month.

25 July 2006

Rates Are Going Up Again

Bargain on another rate hike in August

Economists are overwhelmingly of the opinion that the South African Reserve Bank will raise rates another 50 basis point as soon as August.

This is a radical about-turn from the market view of a few months ago, before global and local financial markets hit turbulence – and before the surprise 50 basis point interest rate increase on June 8.

24 July 2006

Asking Rents Drop in De Waterkant

Since I've started this blog there's been a 2 bedroom townhouse for rent for R3850 in De Waterkant. Well it's been 3 months and it's still there but the asking rent has dropped to R3700.

22 July 2006

Advertising To Flippers

Here's a development that is going out of it's way to advertise to flippers... er I mean investors.

But they don't want speculators. I repeat NO SPECULATORS!

The same experts expecting the residential market to 'lift it's head high' are the same ones who couldn't see bond rate hikes coming despite Tito Mboweni telling them months before he was going to do it. And of course every one is expecting at least another 1% increase in the bond rate, possible more.

So get in and get out in two years but please no speculators. And property experts were predicting no rate increases till Tito raised it 50 base poi

I also love the R5000 a month rental subsidy they give you in the first year. Nothing says strong investor market like incentives from the developer.

CASH FLOW SITUATION FOR THE FIRST YEAR AFTER THE DATE OF REGISTRATION (R 729,900)

If a 30 year bond is obtained, the monthly bond repayment will be R 6229 pm and the positive cash flow R921 pm.

RETURN ON CAPITAL INVESTED AFTER TWO YEARS

* Capital growth on R729,900 at 8% over two years equals R121,455

* Total capital invested : deposit of R20,000

* Return on capital invested (R121,455 over R20,000) = 600%. The positive cash flow above has not been included in the above calculation. It could be used for any possible rental vacancy that might be experienced.

But they don't want speculators. I repeat NO SPECULATORS!

* No sharp increases in the bond rate expected which will continue to stimulate the property market

...

* We expect lower property capital growth rates over the next two years in property up to R1,5 m. Property experts expect the residential market to lift its head high again in 2008. Property is now a long term investment and does not present much opportunity to speculators over a short term.

The same experts expecting the residential market to 'lift it's head high' are the same ones who couldn't see bond rate hikes coming despite Tito Mboweni telling them months before he was going to do it. And of course every one is expecting at least another 1% increase in the bond rate, possible more.

So get in and get out in two years but please no speculators. And property experts were predicting no rate increases till Tito raised it 50 base poi

I also love the R5000 a month rental subsidy they give you in the first year. Nothing says strong investor market like incentives from the developer.

20 July 2006

Truth In Advertising

There was ad for a new development in Malmesbury in the property section today. They had a tag line "30 min to the city!". Yeah 30 minutes if you leave at 4am for work.

Urgent Landlords In Gordon's Bay

Why are all the ads with the words "URGENT" in the title coming out of Gordon's Bay?

Brand new!!!!!!!! 2 Bedroom!!!!! VERY URGENT!!!!!!!!!!!!!

Fully furnished bachelor flat.URGENT!

Brand new!!!!!!!! 2 Bedroom!!!!! VERY URGENT!!!!!!!!!!!!!

Fully furnished bachelor flat.URGENT!

18 July 2006

The Edge: Rents Are Dropping

In May we wrote that you could rent an apartment in The Edge for R5800 a month. Well it seems there were no takers and the same unit is now renting for R5000 a month. Added to that is the fact that almost half of the block is still for sale.

17 July 2006

First Article To Mention Lower Prices

Sound the alarms! Here's the first article to mention...gasp...lowering hice prices!

Time for speculators to cash in?

Every single 'investor' who bought in the last two years just crapped their pants when he mentioned the word 'decrease'.

This is the best quote though:

Time for speculators to cash in?

Typically, there is a higher probability that an investor will sell his property when the market is expected to decrease than that owner-occupants will do so. This, of course, will exacerbate the cooling off in the housing market

Every single 'investor' who bought in the last two years just crapped their pants when he mentioned the word 'decrease'.

This is the best quote though:

The current lull in the market is temporary and will pick up towards the middle of next year"This time it's different!"

15 July 2006

13 July 2006

Desperate Investor Spotting

After never having seen desperate ads from 'investors' before we finally saw one a few days ago. And then today yet another! Check it out:

Smell the desperation!

Quiet, secure, 2 bedrm, garage. URGENTLY NEED NEW TENANTS (R4,200 pcm)

Quiet and secure 2 bedroom flat, bic, fridge, stove, dstv dish, wooden floors, lock up garage. AVAILABLE IMMEDIATELY.

Smell the desperation!

12 July 2006

De Waterkant: Rent Vs. Rent

De Waterkant, R 11,000 - 2 beds/ 2 baths aparment

OR

De Waterkant, R3850 - 2 beds/ lounge townhouse.

I didn't know an extra bathroom is worth an extra R8000 a month.

OR

De Waterkant, R3850 - 2 beds/ lounge townhouse.

I didn't know an extra bathroom is worth an extra R8000 a month.

The Edge: Still Half Empty

The Edge is a development we've written about before. They completed building in April 2006 although they were pre-selling units in 2004. At the time I last wrote 11 units were up for sale (not sure how many of those were resales). According to the developers page (dated May 2006) that has now increased to 15 units on the market! That's just under half the 34 apartments on sale!! If I was an "investor" who is trying to sell and there are still developer owned units (or other "investors" units trying to sell) similar to mine in the building I'd be getting nervous...

The Edge is a development we've written about before. They completed building in April 2006 although they were pre-selling units in 2004. At the time I last wrote 11 units were up for sale (not sure how many of those were resales). According to the developers page (dated May 2006) that has now increased to 15 units on the market! That's just under half the 34 apartments on sale!! If I was an "investor" who is trying to sell and there are still developer owned units (or other "investors" units trying to sell) similar to mine in the building I'd be getting nervous...

09 July 2006

07 July 2006

Economists Now Predict Two More Rate Hikes

A month ago 9 out of 10 economists were predicting no interest rate hikes. Then Tito hiked the rate 50 basis points and now all of a sudden:

Oops.

12% prime rate looming: survey

Economists have reconsidered most of their key economic forecasts over the past month, according to the latest Reuters Econometer survey.

The central view of the fourteen economists surveyed is that the Reserve Bank could lift interest rates at least twice more, taking prime rate to 12% by the first quarter of next year. The rand-dollar rate could reach R7,40 by the end of next year.

Oops.

First Sighting Of A Desperate Investor

Here's my first sighting of a desperate investor trying to find a renter for a newly built and empty unit. It's in Gordon's Bay so it's a helluva drive to Cape Town. The title:

Here's my first sighting of a desperate investor trying to find a renter for a newly built and empty unit. It's in Gordon's Bay so it's a helluva drive to Cape Town. The title:Brand new!!!!!!!! 2 Bedroom!!!!! URGENT!!!!!!!!!!!!! (R2,200 pcm)

just screams "Help! Mortage payments are bleeding me dry!". And check out the last line:

If you are serious, we can talk about the rent !

so there's even room to negotiate down from R2200 a month.

06 July 2006

St Martini Garden: Rent Vs. Rent

A while back I reported on St Martini Garden and how a 1 bedroom flat rents for about R2600 and sells for R699 000. Well now it looks like someone bought and is trying to reduce their massive negative cash flow by trying to rent a similar 1 bedroom unit for R4500 a month! Considering you can get larger, better flats for R1000 less a month without looking very hard (this flat for example) I think this particular 'investor' is going to be bleeding cash for a while.

24 June 2006

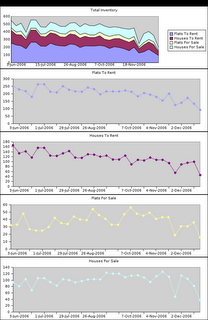

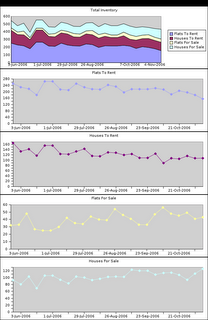

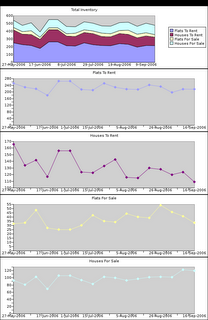

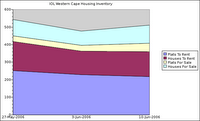

Western Cape IOL Index

22 June 2006

Interest Rates Still Going Up

After Tito Mboweni hiked interest rates it came as a big shock to most economists who were not expecting it. Now suddenly they see rates increasing again before the end of the year:

HE main inflation gauges may have accelerated last month, reflecting a sharp fall in the rand and raising prospects of further interest rate increases this year, according to a Reuters poll.

19 June 2006

Buying Off Plan Is Too Risky

Buying off-plan? Dissect the contract

Rising numbers of people who buy townhouses and apartments off-plan are being faced with the nasty prospect of having the date of delivery of their units postponed.

And while many developers give buyers adequate notice of the delay in delivery, some inform buyers less than a month before occupation that they are no longer able to take ownership of the unit on the specified day.

The consequences can be grim, especially for those who were renting and decided that they are no longer going to service someone else’s bond, as they may have given the required month’s notice already – leaving them highly inconvenienced and technically homeless.

17 June 2006

13 June 2006

What Goes Up

SA house prices outstrip all others

300% in nine years? How much has your salary increased in nine years? What about the rental income of residential housing?

But don't worry there's absolutely nothing wrong with this picture...

HOUSE prices in South Africa have grown quicker than those in any other country monitored by The Economist.

Using the ABSA house price index as a measure, The Economist reports that the average SA house price has rocketed nearly 300% in the last nine years.

300% in nine years? How much has your salary increased in nine years? What about the rental income of residential housing?

But don't worry there's absolutely nothing wrong with this picture...

12 June 2006

Century City: Lots Of Choice

Century City is turning out to be rife with 'inverstors'. Today on property listing site Gumtree four different units in various Centurty City complexes were put online just today.

Century City is turning out to be rife with 'inverstors'. Today on property listing site Gumtree four different units in various Centurty City complexes were put online just today.Brand New 2 Bed Apartment in Villa Italia (R4,250 pcm)

Century Place (R4,700 pcm)

secure village living (R7,000 pcm)

Century City Bougain Villas - Flat to rent (R4,500 pcm)

Me thinks that one going for R7000 might need to reevaluate.

10 June 2006

09 June 2006

St Martini Garden: Rent Vs. Buy

St Martini Garden is an old block of flats in the Cape Town CBD right next to the Company Garden. Again prices are completely out of whack with rents. A one bedroom flat rents for R2600 a month, and they're for sale from R699 000 (I assume that's for the bachelor, but we'll assume it's the price of a one bedrom). Here's the cashflow and yield assuming 11% interest over 20 years:

St Martini Garden is an old block of flats in the Cape Town CBD right next to the Company Garden. Again prices are completely out of whack with rents. A one bedroom flat rents for R2600 a month, and they're for sale from R699 000 (I assume that's for the bachelor, but we'll assume it's the price of a one bedrom). Here's the cashflow and yield assuming 11% interest over 20 years:| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -3593 | -43 |

| 200000 | -2561 | -15 |

| 300000 | -1529 | -6 |

| 400000 | -497 | -1 |

| 500000 | 536 | 1 |

| 600000 | 1568 | 3 |

| 700000 | 2600 | 4 |

Not pretty at all. That's almost 2% less than a fixed deposit. Remember rates, maintenance, insurance and vacancy are not included so the returns are probably a bit less.

ABSA: More Rate Hikes By End Of Year

ABSA says:

If the current inflationary pressures and other negative factors persist into the second half of the year, it is quite possible that interest rates may increase further before the end of the year, Absa said in a statement on Friday.And here's another tidbit:

As a result, we expect nominal growth in house prices to come in at about 11% for the full year, taking into account that average house price growth of 13,8% was recorded in the first five months of the year. For growth in house prices to drop to a level of below 10% in 2006, prices must decline sharply over a wide front before the end of the year

08 June 2006

Rates up 0.5%!!!

Tito Mboweni has raised interest rates 0.5% way above what people were expecting:

The prime rate will rise by 0.5 percentage points to 11 percent after the South African Reserve Bank opted on Thursday to raise the repo rate - at which it lends money to commercial banks - from 7 to 7.5 percent.Well that's economists for you, driving while only looking in the rear view.

Reserve Bank governor Tito Mboweni's announcement came as a surprise to economists and analysts, many of whom had expected interest rates to remain unchanged.

Only one of 16 economists surveyed by Bloomberg forecast a quarter-point increase, while the rest expected the rate to stay unchanged.

06 June 2006

Perspectives: Rent Vs Buy

Perspectives is a new apartment complex in Roeland Street in the Cape Town CBD. You can either rent for R4500/mo or buy at R10000/mo (with 20% down over 20 years).

Perspectives is a new apartment complex in Roeland Street in the Cape Town CBD. You can either rent for R4500/mo or buy at R10000/mo (with 20% down over 20 years).Ouch!

That's some SERIOUS negative cashflow if you're thinking of buying now for an 'investment'. I don't even want to run the numbers of this... Ahhh what the hell:

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -8329 | -100 |

| 200000 | -7331 | -44 |

| 300000 | -6332 | -25 |

| 400000 | -5334 | -16 |

| 500000 | -4336 | -10 |

| 600000 | -3337 | -7 |

| 700000 | -2339 | -4 |

| 800000 | -1341 | -2 |

| 900000 | -342 | 0 |

| 1000000 | 656 | 1 |

| 1100000 | 1655 | 2 |

| 1200000 | 2653 | 3 |

| 1300000 | 3651 | 3 |

EINA!

05 June 2006

Interest Rates Going Up

The Reserve Bank’s next get-together to decide on interest rate policy is scheduled for this week. Although most economists expect rates to stay steady, a surprising number of them are warning that it may no longer be realistic to expect interest rates to stay unchanged for another year.

Interest rates in the balance

03 June 2006

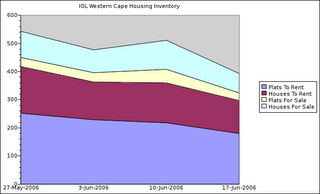

Western Cape IOL Index

Today is the first installment of the IOL Index. This is a highly unscientific graph showing the inventories of different housing categories based on the number of advertisements in the IOL property classifieds for the Western Cape.

29 May 2006

My Eyes!

Here's a listing in Oranjezicht for a tidy R7 000 000. It's got 5 beds, 4 bathrooms and the outside looks quite nice.

But yikes it's obvious no one's lived in it for a while because whoever did the 'staging' (I cry for the real estate industry when they have to do things like this) should be taken out back and beaten. I've seen hospitals with more warmth:

Brrrrr.... I'm cold just looking at it.

But yikes it's obvious no one's lived in it for a while because whoever did the 'staging' (I cry for the real estate industry when they have to do things like this) should be taken out back and beaten. I've seen hospitals with more warmth:

Brrrrr.... I'm cold just looking at it.

Investment Properties That Aren't

Here's another property touting itself as an investment: