30 September 2006

17 September 2006

The Rockwell: Lots Of Inventory To Go

Earlier in May we reported that The Rockwell, a new development in

Earlier in May we reported that The Rockwell, a new development in They've added more units than they've sold in the past 4 months and are now selling on average 7 units a month. At that rate it will take 10 more months for them to sell out completely. However there are two factors still to take into account. Housing sales are heading for a slump as two more interest rates are expected and secondly those early 'investors' are going to be putting their units on the market the second they're completed adding to the inventory available. You can keep up with their development progress here.

16 September 2006

14 September 2006

Rent Vs. Buy: Gardens

Time for another installment of Rent Vs. Buy! This time the area under concern is the Gardens just above the Cape Town CBD. Click on the picture below to see the two apartments (one for rent, the other for purchase) under consideration:

So one two bedroomed apartment for rent for R3800 a month, the other (also two bedroomed) for sale for R1 050 000. Let's run the numbers:

You're only breaking even with a close to 70% down payment and netting a 3% yield with almost a 100% deposit. And to add to the losses we have not factored in rates (knock off at least R600 a month in income, more if the place has an elevator), insurance and maintenance. Something is out of whack if you ask me.

So one two bedroomed apartment for rent for R3800 a month, the other (also two bedroomed) for sale for R1 050 000. Let's run the numbers:

| Down Payment | Monthly Cash Flow | ROI |

|---|---|---|

| 100000 | -6006 | -72 |

| 300000 | -3941 | -16 |

| 500000 | -1877 | -5 |

| 700000 | 187 | 0 |

| 900000 | 2252 | 3 |

You're only breaking even with a close to 70% down payment and netting a 3% yield with almost a 100% deposit. And to add to the losses we have not factored in rates (knock off at least R600 a month in income, more if the place has an elevator), insurance and maintenance. Something is out of whack if you ask me.

12 September 2006

SA Home Loans To Introduce Interest Only Mortages

Sound the alarm bells!!! SA Home Loans(SAHL) is going to introduce interest only mortages:

This is the very type of mortage that sparked off the bubble in the US and is now responsible for the bubble implosion there, with flippers starting to panic as their IO periods reset and they have to start paying off the principle on mortages they can now not afford.

In real terms this is not even a mortage. You're basically renting from the bank during the IO period and when the reset period kicks in and you have to start paying off the principle of the mortage your monthly payments can increase dramatically.

SAHL, also announced the launch of a new type of home loan whereby clients only have to pay the interest on the outstanding balance.

According to Penwarden, the new product allows for huge flexibility as clients can choose to pay either, only the interest, the full monthly instalment or any amount over and above that.

Penwarden believes that this product caters to the needs of modern consumers who no longer pay off a house over the full term of the bond.

This is the very type of mortage that sparked off the bubble in the US and is now responsible for the bubble implosion there, with flippers starting to panic as their IO periods reset and they have to start paying off the principle on mortages they can now not afford.

In real terms this is not even a mortage. You're basically renting from the bank during the IO period and when the reset period kicks in and you have to start paying off the principle of the mortage your monthly payments can increase dramatically.

11 September 2006

R5,2 million For Sand

'Hout Bay sand' selling for R5,2m

Apparently another development built close by to the beach is turning into a disaster:

A sandy plot, which looks like a piece of beach, is up for sale in Hout Bay for R5,2-million.

Some residents thought the estate agent's advertisement was a joke, but the residents' association say the sale is real and an example of the absurd levels to which the development frenzy has risen on the South African coast.

Len Swimmer, chairperson of the Residents' Association of Hout Bay, said of the plot yesterday: "It's right on the beach, a sand dune, and the public access goes right through it.

"We've sent an email to everyone who the estate agents sent the advert to, telling them that we will oppose anything built on that plot," he said.

Apparently another development built close by to the beach is turning into a disaster:

At Hout Bay, earth-moving machines have been brought in to try to keep the sand out of the controversial Beach Club development in the dunes. It is illegal to destroy dunes without a permit.

...

But developers were not known for their "forward thinking" nor for considering the long-term consequences of their actions, he said. As a result, Beach Club homeowners had their gardens "transformed into large sand dunes".

10 September 2006

Number Of Estate Agents To Be Cut In Half

One thing about the bubble housing market is that the number of estate agents rise dramatically. What about in a cooling market? Well let's just say the metaphors used by our business media invoke carnage...

Mass culling of surplus estate agents on the way

That's right folks. From 77 000 agents to 36 000, more than a 50% cut in the estate agent population.

Mass culling of surplus estate agents on the way

THE good times are over for estate agents in the residential property market as rising interest rates turn on the heat and buyers stay away.

“We’ve had a fantastic rainy season, but with the rains have come many weeds. And when the dry season arrives only the trees will be left standing,” said Neville McIntyre, chief executive of Jigsaw Holdings, which includes estate agencies Aida and Realty.

McIntyre said the number of agents had increased from about 57000 in May last year to the current 77000.

This, he said, was because of the low requirements for entry to the occupation — no qualifications are required to become an estate agent.

McIntyre said the industry had the capacity to cope with only 32000 to 36000 agents. He foresees “a major fallout” of estate agents as soon as the residential property market tightens further.

That's right folks. From 77 000 agents to 36 000, more than a 50% cut in the estate agent population.

09 September 2006

Trevor Manuel Begs Consumers To Cut Down On Credit

We're using too much credit, warns Manuel

'I think they will get into trouble'Manuel said Reserve Bank governor Tito Mboweni had on at least three occasions spoken about rising debt and how consumers should limit spending on credit, but the message had not hit home.

"He was sending a warning about this," he said, adding that some people could soon start facing serious problems paying their housing bonds.

Manuel also expressed concern that some stores were offering mortgage and auto finance to their customers.

"I think they will get into trouble. It is this kind of thing that feeds the appetite (spending on credit), resulting in people being addicted to credit," he continued.

07 September 2006

Tito Targets House Prices With Rate Hikes

In the US, Federal Reserve Chairman Ben Bernanke has not mentioned housing prices as a cause for raising interest rates out of fear that he might cause their imploding bubble to crater overnight. Our Reserve Bank Governor Tito Mboweni however knows when to call a spade a spade:

We had not properly anticipated or priced in the sociology of interest rate reductions -- economics is about human behaviour -- and the sociology of the lower interest rate environment was that for the bulk of the population the experience of these interest rates was unknown -- they went and bought a second

or third car, five DVD systems, ten handbags, three or four houses -- they went on a spending spree such that loans and advances to the private sector was at 23% in June and then rose to 34,6% in July

06 September 2006

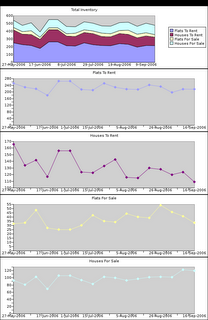

Asking Prices Head South

Although not as widely used as it could be PrivateProperty.co.za allows us to see when properties

have their asking price reduced.

Of the 16 properties listed in the City Bowl 9 are price reduced.

Of the 22 properties listed in the Atlantic Seaboard 9 are price reduced.

have their asking price reduced.

Of the 16 properties listed in the City Bowl 9 are price reduced.

Of the 22 properties listed in the Atlantic Seaboard 9 are price reduced.

04 September 2006

Building Boom Brings Shoddy Workmanship

The property bubble has meant a lot of things. Higher property prices, rampant credit spending and now substandard buildings:

There's only so much skilled labour around, and with all the new construction and rushed deadlines it's stretched pretty thin. And this rising number of accidents on work sites is an indication of crappy labour and substandard quality control. So if you're sitting in your newly built development townhouse, you might want to start checking the walls for cracks every now and then.

The current property boom and pressure to meet building deadlines are cited as the main reasons why construction companies flout building regulations, resulting in an increasing number of accidents.

The employment of unskilled workers and failure to provide training has also resulted in many fatal incidents.

There's only so much skilled labour around, and with all the new construction and rushed deadlines it's stretched pretty thin. And this rising number of accidents on work sites is an indication of crappy labour and substandard quality control. So if you're sitting in your newly built development townhouse, you might want to start checking the walls for cracks every now and then.

03 September 2006

Housing Prices: No One Has A Clue!

As the outlook for housing prices continues to get bleaker the interesting thing to note is that the snoozing economists at our major banks don't seem to know what the hell is going on. Observe this quote:

Two economists at two of our biggest banks have a nealry 100% discrepancy in price growth outlook? That's just a tad worrying to me. I don't care how different their methodology or how client base is, a disparity that big means we're moving into into a time when economists are literally pulling numbers out of thin air because they have no idea what the market will do.

Jacques du Toit, Absa property economist, expects house price inflation to average 12% this year....

Standard Bank released its equivalent index earlier this week, which reflected July house price inflation of 6%...

Two economists at two of our biggest banks have a nealry 100% discrepancy in price growth outlook? That's just a tad worrying to me. I don't care how different their methodology or how client base is, a disparity that big means we're moving into into a time when economists are literally pulling numbers out of thin air because they have no idea what the market will do.

02 September 2006

Subscribe to:

Posts (Atom)